Welcome To Shalom College

Be HERE, BE VIBRANT!

Join our college and take control of your learning journey .

Congratulations

Your admission is successfully confirmed.

Our Academics

Our mission is to educate our students and prepare them for life.

Undergraduate

Graduate

TVET

Training

About Us

Shalom Business and Technology College is a young and dynamic higher education institution established in 2019 in Hawassa, the capital city of the Sidama Regional State, Ethiopia. The College operates under the accreditation and supervision of the Education and Training Authority Ethiopia (ETA), ensuring that all its academic programs meet national standards of quality and relevance. Since its establishment, Shalom College has been dedicated to providing transformative education in the fields of business, technology, and related disciplines. The institution focuses on equipping students with practical skills, critical thinking, and ethical values necessary to excel in today’s fast-evolving world. With a growing reputation for academic excellence, innovation, and community engagement, Shalom Business and Technology College stands as a beacon of opportunity for young people aspiring to build successful careers and contribute meaningfully to Ethiopia’s social and economic development.

Learn MoreOur Programs

Here are our graduate programs

Undergraduate Programs

Graduate Programs

Our Values

Our Vision

Our vision is to be one of Ethiopia's centre of excellence in education, research, and community service by 2025.

Our Mission

Our Mission is to empower students with the knowledge, skills, and ethical values necessary to become responsible citizens. Through a rigorous academic curriculum and participative learning opportunities, we aim to inspire our students to achieve their full potential and positively impact society.

Our History

Shalom Business and Technology College is a young and dynamic higher education institution established in 2019 in Hawassa, the capital city of the Sidama Regional State, Ethiopia. The College operates under the accreditation and supervision of the Education and Training Authority Ethiopia (ETA), ensuring that all its academic programs meet national standards of quality and relevance.

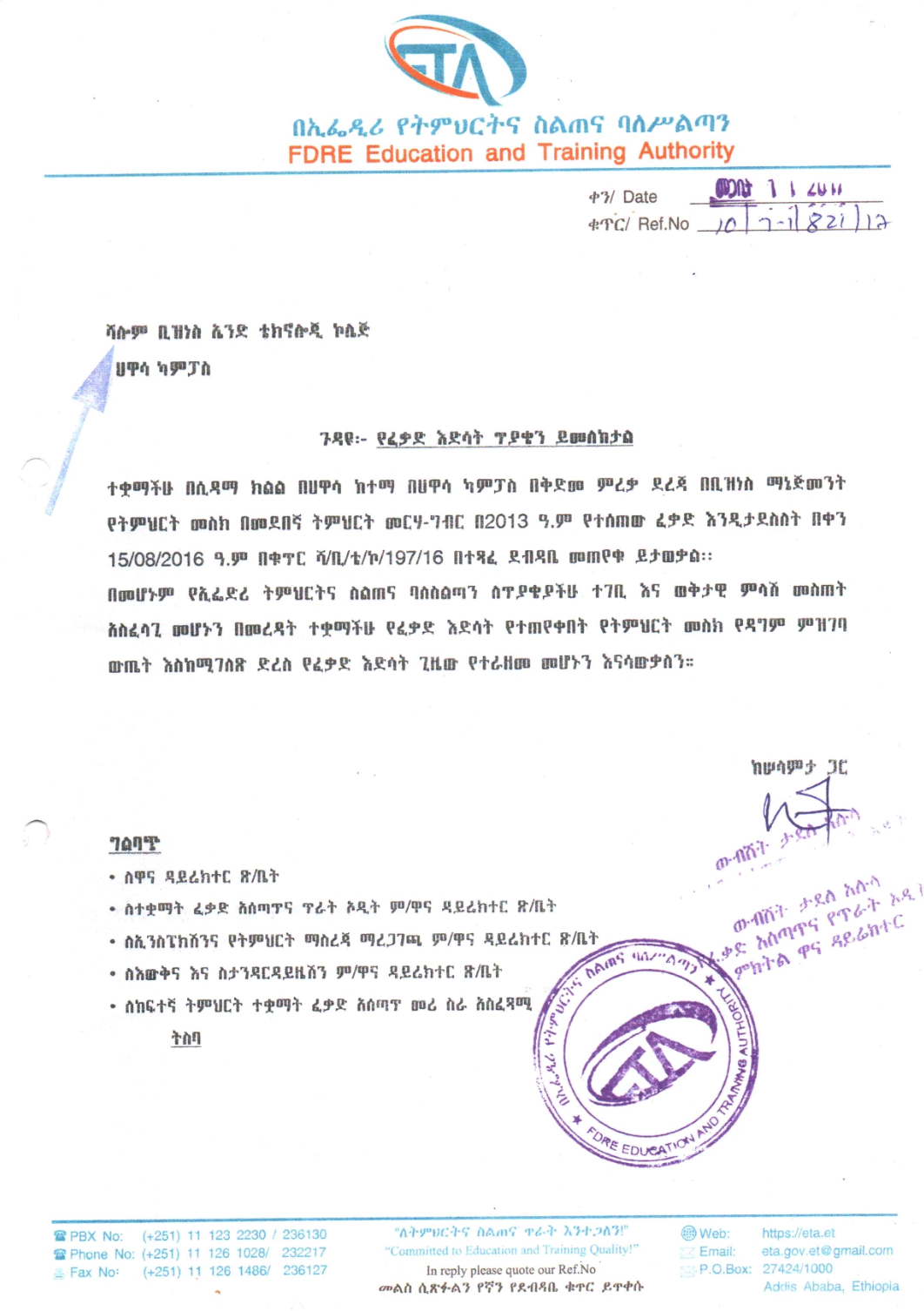

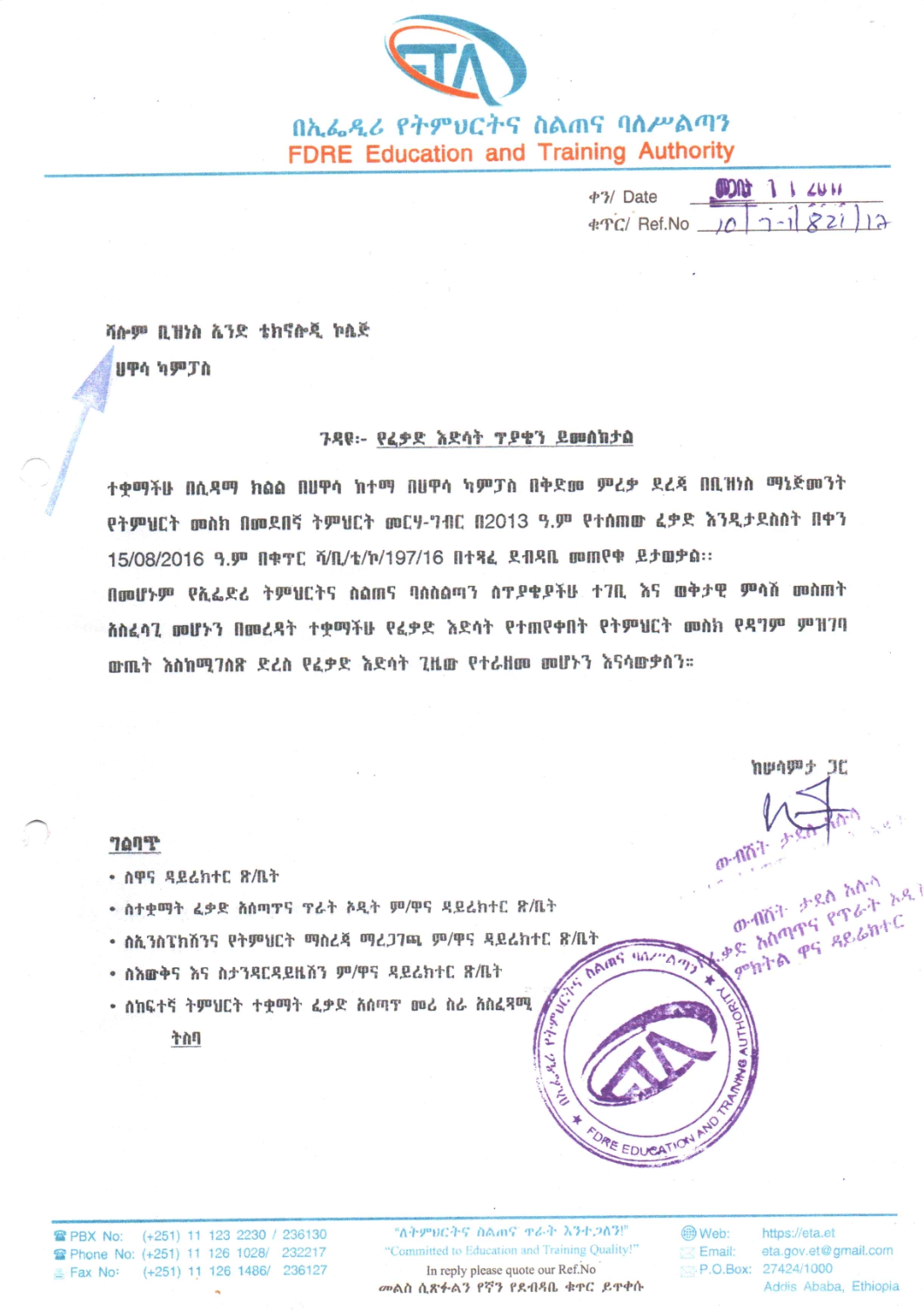

Accreditations

Here are our Accreditations for our programs

- Graduate Program

- Online Modality

Contact us

Access the right education for your future today!!

.jpeg)

.jpeg)

.jpeg)